The Importance Of Establishing An Emergency Fund

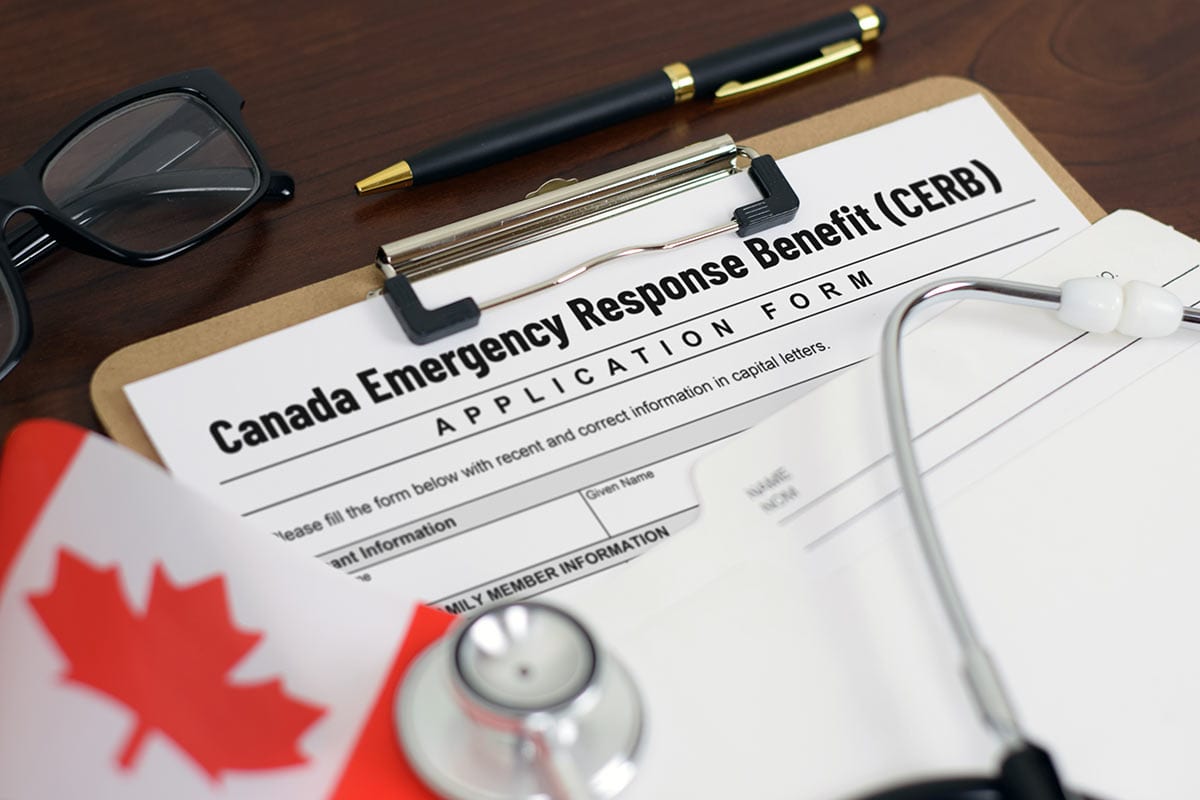

We are currently living through an unprecedented moment in time. The spread of the novel coronavirus, COVID-19, has impacted the livelihood of people all over the world including here in Canada. Millions of Canadians have already filed for unemployment benefits, as well as the Canadian Emergency Response Benefit (CERB), in response to temporary layoffs and employment terminations.

The COVID-19 outbreak is a stark reminder that emergencies will happen and it echoes the importance of establishing an emergency fund for you and your family. Here are a few reasons why you should create one if you haven’t already.

You Have Existing Debt

Debt can be hard to manage, but it can be especially troubling when unexpected costs arise in one’s life. Emergency funds are designed to prevent individuals from adding to their existing debt while allowing them to pay for unforeseen situations such as vehicle repairs, home repairs, or job loss. The emergency fund will act as a metaphorical band-aid until you’re able to get your finances under control.

You Have Your Own Family

If your household brings in one full-time income, it’s important to establish an emergency fund as soon as you possibly can. If you’re the mother or father of a child, or you’re expecting a child, an emergency fund will allow you to dip into some accessible money even if you lose your job or become unable to work due to injury. The emergency fund will give you leeway to purchase necessities like diapers, groceries, and clothing while your income is temporarily halted. Additionally, even if you establish an emergency fund that you never use, you can use that money for other important purposes such as saving for your kids’ education.

You’re Saving Up For Something

Sudden changes to your income can completely derail the plans that you’ve worked so hard for. Job loss or unexpected expenses may require you to dip into your savings account, where you’ve stored money for an upcoming vacation, a small business idea, or a down payment for a new home. Take some of the expendable money that you would typically use for splurging (i.e. online shopping, ordering takeout, etc.) and put it into an emergency fund. Consider your emergency fund as an insurance policy for your dreams and aspirations – don’t allow unforeseen charges to prevent you from living life to the fullest!

During these uncertain times, we wish nothing but health and happiness for everyone. We will get past this and when we do, we want everyone to take a deeper look into their financial situation and establish an emergency fund that will protect them and their families from costly emergencies and unforeseen expenses. For more information on how to establish an emergency fund, contact Andrea Orr today!

Leave A Comment

You must be logged in to post a comment.